Key information

As a feeder fund, DJE - Concept will permanently invest at least 85% of its net sub-fund assets in the FMM fund as a master fund from 1 March 2024. The liquidity of DJE - Concept will be limited to 15%. The fund may acquire units in the master fund up to 100% of its fund assets.

Responsible manager since inception

Key information

| ISIN: | LU0124662932 |

| WKN: | 625797 |

| Category: | Fund EUR Flexible Allocation - Global |

| VG/KVG: | DJE Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 3 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 06/04/2001 |

| Fund Currency: | |

| Fund Size (17/04/2024): | 88,35 Mio |

| TER p.a. (29/12/2023): | 1,21 % |

| Reference Index: | - |

Fees

| Management Fee p.a.: | 0,950 % |

| Custodian Fee p.a.: | 0,060 % |

Ratings & Awards (17/04/2024)

| Morningstar*: |

|

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | A |

| ESG-Qualityrating (0-10): | 6,859 |

| Environment Rating (0-10): | 6,013 |

| Social Rating (0-10): | 5,630 |

| Governance-Rating(0-10): | 5,904 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 34,750 % |

| Peergroup: |

Mixed Asset EUR Flex - Global

(1528 Fonds) |

| Coverage rate ESG rating: | 81,197 % |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 185,344 |

Portfolio allocation according to ESG rating of individual securities

Report date: 29/02/2024

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Risk metrics (17/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 6,17 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -4,03 % |

| Maximum Drawdown (1 year): | -3,62 % |

| Sharpe Ratio (2 years): | -0,59 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Top Country Allocation (28/03/2024) |

|

|---|---|

| Luxembourg | 99,62 % |

Asset Allocation (28/03/2024) |

|

|---|---|

| Funds | 99,62 % |

| Cash | 0,38 % |

Investment strategy

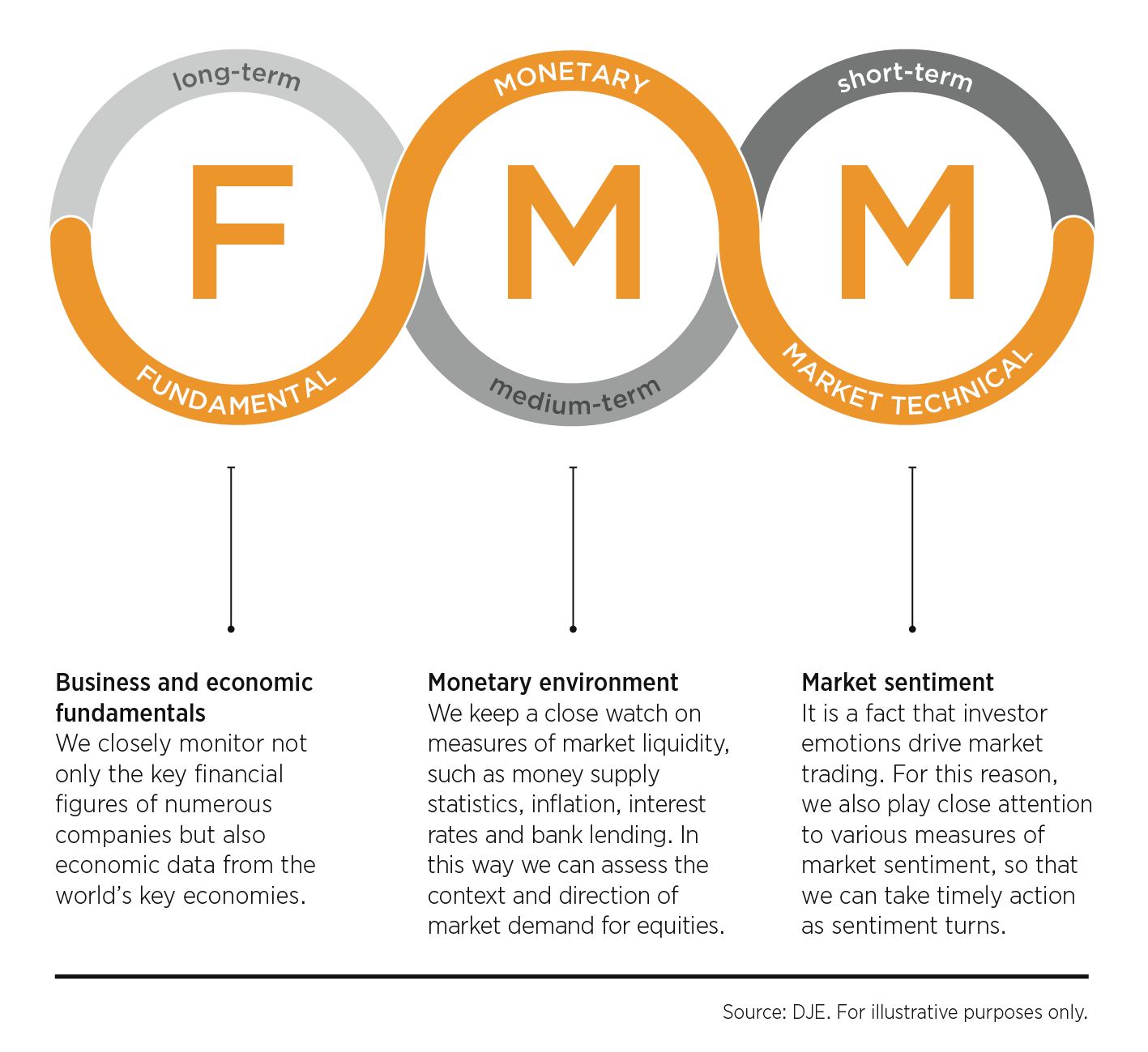

DJE - Concept invests its fund assets in units of the FMM-Fonds.This fund is an investment concept which is managed independently of any benchmark constraints with the aim to achieve an optimal risk/reward profile. The basis is the three-dimensional FMM-methodology, which was developed by Dr Jens Ehrhardt and has a proven track record of more than 45 years. According to the methodology the following factors are taken into account: (F)undamental factors like micro- and macroeconomic data for corporations and economies, but also (M)onetary and technical (M)arket aspects such as sentiment which are often neglected by other fund managers. Fundamental factors play a more important role in the long-term strategic orientation of the portfolio than, for example, technical market factors. The latter are more significant for the fund’s short-term, tactical positioning. In normal market phases, the FMM-Fonds focuses on current trends. In extreme situations (such as during euphoric phases), the fund can also follow an anticyclical investment strategy.

Chances

- Experienced fund manager following an investment approach based on fundamental, monetary and market-technical (FMM) analysis, which has a proven track record since 1974

- Efficient mixture of equities and bonds with strategic risk diversification

- The opportunities of the global equity and bond markets may be used – the fund is not restricted to one region or country

Risks

- Equities may be subject to significant price falls

- Currency risks resulting from the portfolio’s foreign investments

- Issuer country, credit and liquidity risks

- Price risks of bonds when interest rates rise

Monthly Commentary

No commentary is provided for this fund.