Key information

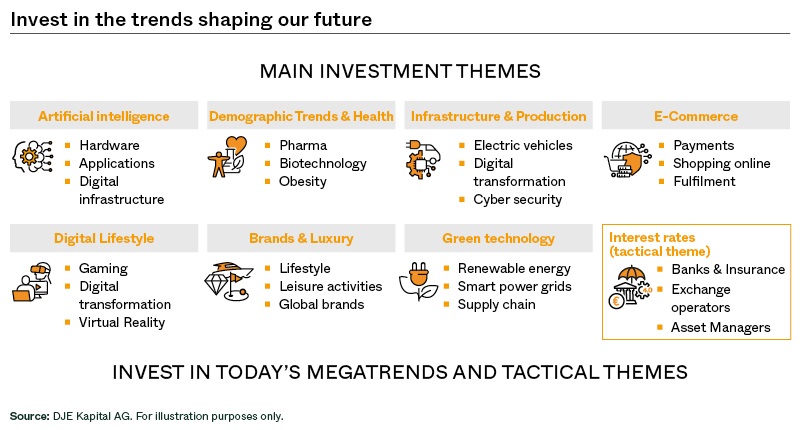

DJE - Multi Asset & Trends is a dynamic global multi-asset fund. The diversified portfolio of approximately 50 to 70 equities and between 20 to 40 bonds is managed independent from any benchmark. The fund management pursues a thematic approach to benefit from current and long-term trends, including digital transformation, demographics & health, and clean technologies. The strategy targets companies with stable business models and above-average growth prospects, combined with reasonable valuations. Additional diversification is achieved by investing in up to 10% of the portfolio in gold. The fund seeks to exploit global opportunities to generate an attractive performance.

Responsible manager since 23/01/2017

Key information

| ISIN: | LU0159549145 |

| WKN: | 164317 |

| Category: | Fund EUR Flexible Allocation - Global |

| Minimum Equity: | 51% |

| Partial Exemption of Income ¹: | 30% |

| VG/KVG: | DJE Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 4 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | distribution |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 27/01/2003 |

| Fund currency: | EUR |

| Fund Size (22/04/2024): | 289,25 Mio EUR |

| TER p.a. (29/12/2023): | 1,86 % |

| Reference Index: | - |

Fees

| Initial Charge: | 4,000 % |

| Management Fee p.a.: | 1,600 % |

| Custodian Fee p.a.: | 0,060 % |

|

Performance Fee p.a.: 10% of the unit value development, provided the unit value at the end of the settlement period is higher than the highest unit value at the end of the previous settlement periods of the last 5 years [High Water Mark Principle]. The settlement period begins on 1 January and ends on 31 December of a calendar year. Payment is made at the end of the accounting period. For further details, see the sales prospectus. |

Ratings & Awards (22/04/2024)

| Morningstar*: |

|

|

Awards: Scope Award 2023 Best Fund in the category "Mixed Fund Global Flexible" in Switzerland |

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | A |

| ESG-Qualityrating (0-10): | 6,960 |

| Environment Rating (0-10): | 6,052 |

| Social Rating (0-10): | 5,333 |

| Governance-Rating(0-10): | 5,726 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 43,390 % |

| Peergroup: |

Mixed Asset EUR Agg - Global

(431 Fonds) |

| Coverage rate ESG rating: | 87,947 % |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 116,158 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/03/2024

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Rolling performance in %

Risk metrics (22/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 9,39 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -5,94 % |

| Maximum Drawdown (1 year): | -4,20 % |

| Sharpe Ratio (2 years): | 0,07 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 28/03/2024

Top Ten Holdings in % of Fund Volume

| Equity Portfolio | Portfolio ex Equities | ||

|---|---|---|---|

| ALLIANZ SE-REG | 2.28% | INVESCO PHYSICAL GOLD ETC | 6.64% |

| ALPHABET INC-CL C | 2.27% | UNITED MEXICAN STATES (4.875%) | 2.42% |

| MICROSOFT CORP | 2.09% | BUONI POLIENNALI DEL TES (4.20 | 1.74% |

| AMAZON.COM INC | 1.93% | US TREASURY (2.375%) (2.3750%) | 1.56% |

| HANNOVER RUECKVERSICHERU-REG | 1.73% | NORWEGIAN GOVERNMENT (1.75%) ( | 1.30% |

| VISA INC-CLASS A SHARES | 1.71% | US TREASURY (4.875%) | 1.28% |

| LINDE PLC | 1.65% | US TREASURY N/B | 0.91% |

| NOVO NORDISK A/S-B | 1.61% | MSCI INC (4.00%) | 0.85% |

| NVIDIA CORP | 1.53% | US TREASURY (3.50%) | 0.83% |

| DEUTSCHE BOERSE AG | 1.49% | SOFTBANK GROUP CORP (2.8750%) | 0.80% |

Current status: 28/03/2024

When buying a fund, one acquires shares in the said fund, which invests in securities such as shares and/or in bonds, but not the securities themselves.

Top Country Allocation in % of Fund Volume (28/03/2024) |

|

|---|---|

| United States | 42,24 % |

| Germany | 14,41 % |

| Japan | 10,08 % |

| France | 4,58 % |

| United Kingdom | 3,21 % |

Asset allocation in % of the fund volume (28/03/2024) |

|

|---|---|

| Stocks | 68,03 % |

| Bonds | 23,41 % |

| Certificates | 7,05 % |

| Cash | 1,51 % |

Investment strategy

The asset allocation of the DJE - Multi Asset & Trends fund follows a consistent bottom-up approach. It is based on fundamental factors such as market positioning, balance sheet and earnings potential, valuation, management quality, and sustainability criteria. The fund management takes a flexible approach to asset classes and allocates across sectors and countries with the aim of managing risk and capitalising on opportunities that arise. Gold is an asset class that has a low correlation with equities and bonds and provides additional stability; it can represent up to 10% of the fund. With the growth-oriented risk-reward profile and broad diversification across different asset classes, the fund aims for attractive returns combined with low volatility.

Chances

- The cash quota (up to 49%) can be used flexibly in order to cushion difficult market phases as much as possible.

- Equities enable participation in the growth opportunities of the global equity markets independently of benchmark index specifications.

- Flexible addition of bonds (up to 50%) and other securities such as certificates on precious metals (up to 10% gold) possible.

- Offensive, theme-oriented, global multi-asset fund with ongoing adjustment of its portfolio to the expected market situation.

Risks

- Bonds are subject to price risks when interest rates rise, as well as country risks and the creditworthiness and liquidity risks of their issuers.

- In the case of securities not denominated in euros, there is a currency risk for euro investors.

- An investment in precious metals is subject to fluctuations in value.

- Share prices can fluctuate relatively strongly due to market, currency and individual value factors.

Target group

Der Fonds eignet sich für Anleger

- who wish to reduce risk through broad diversification of investments

- with a medium to long-term investment horizon

- who wish to reduce risk compared to a direct investment

Der Fonds eignet sich nicht für Anleger

- who seek safe returns

- with a short-term investment horizon

- who are not prepared to accept increased volatility

Monthly Commentary

In March, the stock markets largely continued their bullish trend from the previous months. The German share index DAX rose by 4.61% to a new record high. The broad European index Stoxx Europe 600 also performed well, rising by 3.65%. The US S&P 500 index also recorded growth of 3.14%. Hong Kong's Hang Seng Index, on the other hand, moved sideways with a gain of 0.18%. Overall, global equities, as measured by the MSCI World Index, rose by 3.12% - all index figures in euro terms. The rise on the stock markets in the first quarter was driven by good or improving economic data, which turned out better than widely expected. These included continued solid figures from the US labour market, an improving Purchasing Managers' Index for services in the eurozone and fiscal stimulus in China, which should help to achieve the growth target. This turned the initial fears of recession into hopes that a soft landing in the major economic regions was still possible. As a result, expectations of interest rate cuts, which were still very high at the beginning of the year, have now shifted to the middle of the year. Especially as consumer prices in the USA rose again in February. The US Federal Reserve therefore remained cautious and intends to wait for further data. In turn, the European Central Bank signalled in March that it might cut interest rates for the first time in June. The price of gold rose by 9.08% to USD 2,229.87 per troy ounce, reaching a new record high. The DJE - Multi Asset & Trends rose by 3.10% in this market environment. All sectors of the MSCI World global equity index performed well in March. The energy, financial institutions and basic materials sectors achieved particularly high gains. The lowest gains came from the Consumer Goods & Services, Travel & Leisure and Automotive sectors. The fund achieved the best results through its stock selection in the Construction & Materials, Utilities and Chemicals sectors. The fund achieved the lowest gains in the Consumer Goods & Services and Food & Beverages sectors. Only the Industrials sector produced a negative result for the fund. The fund management adjusted the sector allocation slightly compared to the previous month. It increased the weighting of the financial institutions, chemicals, industrials and healthcare sectors and reduced the technology and energy sectors. The fund's equity allocation rose from 66.74% to 68.03% as a result of the adjustments. The bond portfolio mainly moved sideways, as the shift in interest rate expectations on the bond markets led to different results. High-quality corporate bonds, which benefited from hopes of an economic recovery, performed best. High-yield corporate bonds, on the other hand, fell. The bond ratio at the end of the month was 23.41% (previous month: 22.28%). The certificate ratio rose from 6.00% to 7.05%. As a result of the allocation adjustments, the fund's liquidity fell from 4.98% to 1.51%.