Key information

The DJE - Short Term Bond, invests globally and draws on the various parts of global fixed income markets with a focus on short maturities and investment grade ratings. The fund primarily invests in bonds denominated in Euro. The fund invests in a selection of high-quality securities based on a thorough analysis of fundamental data in addition to broad market analysis in search for global yield opportunities. The fund is managed without any constraints on sectors, countries, credit ratings or benchmark indexes. With its global spectrum of short-dated bonds, the fund offers a balanced risk/reward profile and aims to achieve a positive performance.

Responsible manager since inception

Responsible manager since 19/07/2022 as co-manager

Key information

| ISIN: | LU0159549814 |

| WKN: | 164321 |

| Category: | Fund EUR Diversified Bond - Short Term |

| VG/KVG: | DJE Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 2 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 27/01/2003 |

| Fund Currency: | |

| Fund Size (15/04/2024): | 295,62 Mio |

| TER p.a. (29/12/2023): | 0,72 % |

| Reference Index: | - |

Fees

| Initial Charge: | 1,000 % |

| Management Fee p.a.: | 0,530 % |

| Custodian Fee p.a.: | 0,060 % |

Ratings & Awards (15/04/2024)

| Morningstar*: |

|

|

Awards: €uro Fund Award 2024 1st place over 10 years in the category "Bonds Euroland/Short-term" |

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | A |

| ESG-Qualityrating (0-10): | 6,723 |

| Environment Rating (0-10): | 6,182 |

| Social Rating (0-10): | 5,723 |

| Governance-Rating(0-10): | 5,802 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 38,830 % |

| Peergroup: |

Bond Global EUR

(618 Fonds) |

| Coverage rate ESG rating: | 77,658 % |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 129,515 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/03/2024

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Risk metrics (15/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 2,22 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -1,37 % |

| Maximum Drawdown (1 year): | -0,79 % |

| Sharpe Ratio (2 years): | -0,31 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Top Country Allocation (28/03/2024) |

|

|---|---|

| United States | 40,35 % |

| Germany | 22,77 % |

| Netherlands | 6,53 % |

| Italy | 6,50 % |

| Finland | 3,40 % |

Asset Allocation (28/03/2024) |

|

|---|---|

| Bonds | 97,13 % |

| Cash | 2,87 % |

Investment strategy

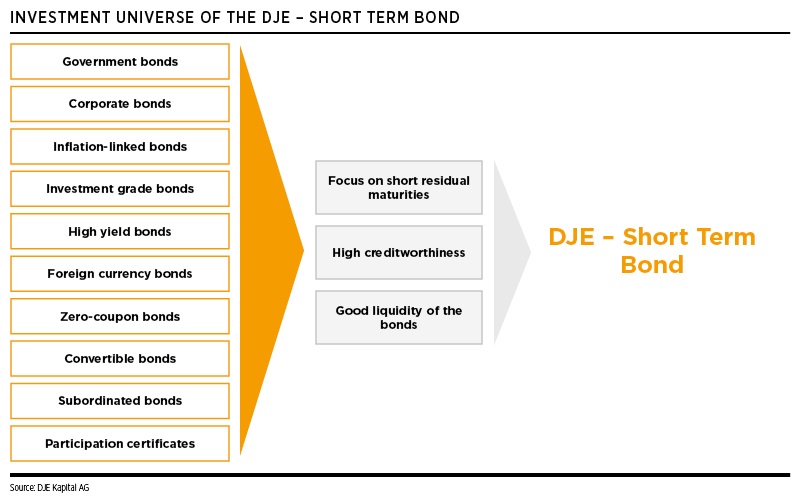

The focus is on bonds with short residual maturities, good liquidity and high-quality credit ratings. The strategy focuses on corporate and government bonds, mortgage bonds, profit participation certificates, zero-coupon bonds and variable-interest debt instruments. The DJE - Short Term Bond achieves a low currency risk by investing predominantly in EUR securities, whereby part of the fund assets can also be invested in foreign currency bonds. Active duration management using interest rate derivatives and management of residual maturities reduces the risk of interest rate changes. The balanced portfolio and the investment horizon geared to short maturities intends to avoid major fluctuations in the strategy and achieve a stable performance.

Chances

- Global bond fund with a focus on high-quality bonds with short maturities.

- Moderate investment horizon offers an attractive risk-return profile.

- Active interest rate, maturity and risk management.

Risks

- Bonds are also subject to country risks and the creditworthiness and liquidity risks of their issuers.

- Bonds are subject to price risks when interest rates rise.

- In the case of securities not denominated in euros, there is a currency risk for euro investors.

Monthly Commentary

The rise on the stock markets in March, as in the first quarter as a whole, was fuelled by good or improving economic data, which turned out better than widely expected. This turned fears of recession into hopes that a soft landing in the major economic regions was still possible. Expectations of interest rate cuts, which were still very high at the beginning of the year, have therefore shifted to the middle of the year. Especially as consumer prices in the USA rose again in February. Inflation was 3.2% compared to the previous year; in January it was 3.1%. Accordingly, the US Federal Reserve remained cautious and intends to wait for further data. In turn, the European Central Bank signalled in March that it might cut interest rates for the first time in June. In the eurozone, inflation fell to 2.6% year-on-year in February (January: 2.8%). The shift in interest rate expectations led to different results on the bond markets. Short-term government bonds largely moved sideways: 2-year German government bonds yielded a moderate 5 basis points lower at 2.85% and their US counterparts only one basis point lower at 4.62%. Hopes of an economic recovery benefited high-quality corporate bonds, whose yields fell by 11 basis points to 5.30% in the USA and by 20 basis points to 3.66% in Europe. High-yield US corporate bonds also benefited from this, with yields also falling by 20 basis points to 7.66%. In contrast, yields on high-yield European corporate bonds rose by 27 basis points to 7.56%, as the economic environment in the eurozone is not as stable as in the USA and key interest rates are not expected to be lowered until June - meaning that growth will continue to have to be financed more expensively. The DJE - Short Term Bond rose by 0.76% in this market environment. The fund benefited above all from the lower risk premiums on high-quality corporate bonds and US high-yield bonds. The fund management acquired a US corporate bond from the basic materials sector and a supranational bond denominated in Mexican pesos. In addition, a euro-denominated bond from the chemicals sector was also purchased. The adjustments increased the fund's investment ratio to 97.13% (previous month: 94.17%). In order to capitalise on the positive momentum in corporate bonds and to benefit from falling interest rates in the future, the fund management increased the modified duration of the portfolio (including cash and derivatives) from 1.99% to 2.23%.