Key information

DJE - Dividende & Substanz focuses on companies with stable and attractive dividends as well as strong balance sheets. The fund management also takes into account additional shareholder-friendly corporate policies such as stock buybacks (total shareholder return). The fund invests globally and independent from any market benchmarks. Security selection is driven by a combination of quantitative and qualitative analysis and assessment of companies. We consider a broad range of indicators and financials statement figures and ratios in our investment decisions. The overall portfolio aims for an above-average dividend yields relative to the broader market; however, the fund may also invest in equities that do not currently pay a dividend.

Responsible manager since inception

Responsible manager since 01/07/2019 as co-manager

Key information

| ISIN: | LU0159550150 |

| WKN: | 164325 |

| Category: | Fund Global Equity Income |

| VG/KVG: | DJE Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 4 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 27/01/2003 |

| Fund Currency: | |

| Fund Size (17/04/2024): | 1.135,86 Mio |

| TER p.a. (29/12/2023): | 1,88 % |

| Reference Index: | - |

Fees

| Initial Charge: | 5,000 % |

| Management Fee p.a.: | 1,670 % |

| Custodian Fee p.a.: | 0,060 % |

|

Performance Fee p.a.: 10% of the [Hurdle: exceeding 6% p.a.] unit value performance, provided the unit value at the end of the settlement period is higher than the highest unit value at the end of the previous settlement periods of the last 5 years [High Water Mark Principle]. The settlement period begins on 1 January and ends on 31 December of a calendar year. Payment is made at the end of the accounting period. For further details, see the sales prospectus. |

Ratings & Awards (17/04/2024)

| Morningstar*: |

|

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | AA |

| ESG-Qualityrating (0-10): | 7,261 |

| Environment Rating (0-10): | 6,183 |

| Social Rating (0-10): | 5,444 |

| Governance-Rating(0-10): | 5,724 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 70,060 % |

| Peergroup: |

Equity Global

(5547 Fonds) |

| Coverage rate ESG rating: | 97,670 % |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 161,521 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/03/2024

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Risk metrics (17/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 10,32 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -6,60 % |

| Maximum Drawdown (1 year): | -5,18 % |

| Sharpe Ratio (2 years): | -0,10 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Top Country Allocation (28/03/2024) |

|

|---|---|

| United States | 39,26 % |

| Germany | 12,81 % |

| France | 7,85 % |

| Switzerland | 4,39 % |

| Japan | 4,01 % |

Asset Allocation (28/03/2024) |

|

|---|---|

| Stocks | 98,88 % |

| Cash | 1,12 % |

Investment strategy

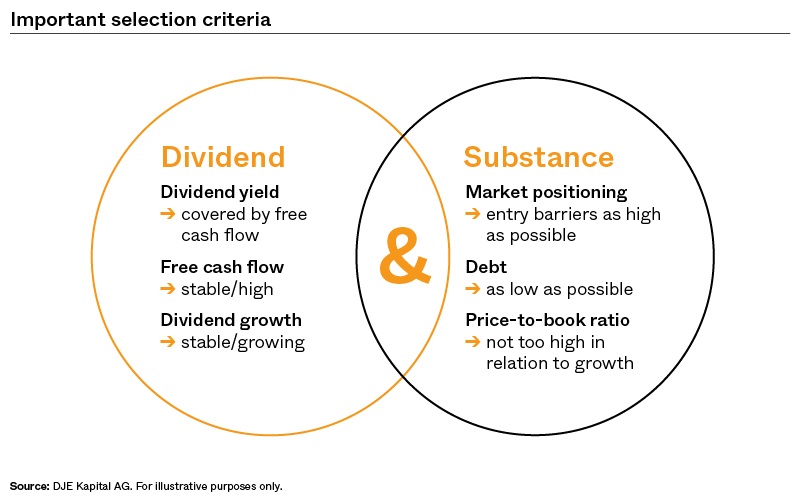

High-dividend stocks are a source of recurring income, but their importance is often underestimated. In the long term, dividends often make the biggest contribution to stock portfolio performance, as reinvested dividends facilitate the compounding effect. This is why stocks with above-average dividend yields are the focus of the DJE - Dividende & Substanz fund. When selecting high dividend stocks, a stable, increasing dividend payment is more important than the absolute level of the current dividend yield. Historical data shows that high-dividend stocks can be more stable in difficult market phases relative to low-dividend stocks. Hence, dividends can act as a buffer to mitigate temporary capital losses. This is mainly because stable businesses with strong balance sheets and high dividend yields as well as protective entry barriers to their markets and products increase the chance of long-term investment success. The stock selection of the portfolio aims for an above-average dividend yield relative to the broader market; however, the fund may also invest in equities that do not currently pay a dividend.

Chances

- Experienced fund manager with an approach based on fundamental, monetary and market analysis (FMM) that has proven itself since 1974.

- Attractive level of global dividend stocks.

- Participation in the growth opportunities of global equity markets independent of benchmark index specifications.

- Dividends offer regular income potential in addition to possible share price gains and can thus mitigate possible price losses.

Risks

- Share prices can fluctuate relatively strongly due to market, currency and individual value factors.

- Dividends are a voluntary payment by companies and therefore not guaranteed. They can rise, fall or be cancelled altogether.

- Currency risks due to a high foreign share in the portfolio.

- Previously proven investment approach does not guarantee future investment success.

Monthly Commentary

In March, the equity markets largely continued their bullish trend from the previous months. The rise on the stock markets in the first quarter was driven by good or improving economic data, which turned out better than widely expected. These included continued solid figures from the US labour market, an improving purchasing managers' index for services in the eurozone and fiscal stimulus in China, which should help to achieve the growth target. This turned the initial fears of recession into hope that a soft landing in the major economic regions was still possible. In this market environment, the DJE - Dividende & Substanz gained 3.59%. All sectors of the MSCI World global equity index performed well in March. The energy, financial institutions and basic materials sectors achieved particularly high gains. The lowest gains came from the Consumer Goods & Services, Travel & Leisure and Automotive sectors. The fund management left the sector allocation virtually unchanged compared to the previous month. The only notable exception was the reduction in the healthcare sector. The fund's investment ratio fell from 100.13% to 98.88%, with a corresponding liquidity ratio of 1.12%.