Key information

The DJE Gold & Stabilitätsfonds combines various asset classes in an investment strategy aimed at absolute return. The fund invests in precious metals, short-term bank deposits, equities from the sectors basic materials, health care, utilities, real estate, telecommunication and agriculture as well as in Swiss companies and investment grade government bonds. It may also invest in corporate bonds from the above-mentioned sectors. Up to 30% of the fund may invest in physical gold. The total investment in gold (directly or indirectly through certificates) may not exceed 49% of the fund’s assets. The objective of the fund is to generate a steady return. The fund’s currency is the Swiss Franc. However, the fund is managed from a Euro investors perspective, so the performance in Euro is taken into account.

Responsible manager since 01/01/2010

Key information

| ISIN: | LU0323357649 |

| WKN: | A0M67Q |

| Category: | Fund CHF Moderate Allocation |

| Minimum Equity: | 25% |

| Partial Exemption of Income ¹: | 15% |

| VG/KVG: | DJE Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 3 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | distribution |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 01/04/2008 |

| Fund currency: | CHF |

| Fund Size (22/04/2024): | 199,46 Mio |

| TER p.a. (29/12/2023): | 1,77 % |

| Reference Index: | - |

Fees

| Initial Charge: | 5,000 % |

| Management Fee p.a.: | 1,550 % |

| Custodian Fee p.a.: | 0,070 % |

|

Performance Fee p.a.: 10% of the unit value development, but no more than 2.5% of the average net fund assets in the accounting period, insofar as the unit value at the end of the accounting period exceeds the unit value at the end of the previous accounting periods. The accounting period begins on 1 January and ends on 31 December of a calendar year. The first accounting period begins on 1.4.2021 and ends on 31.12.2022. Payment is made at the end of the accounting period. For further details, see the sales prospectus. |

Ratings & Awards (22/04/2024)

| Morningstar*: |

|

|

Awards: Best Asset Manager 2023 Place 5 out of 557 funds in the category "Dynamic" in the ranking of Wirtschaftswoche and MMD |

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | AA |

| ESG-Qualityrating (0-10): | 7,144 |

| Environment Rating (0-10): | 6,163 |

| Social Rating (0-10): | 5,450 |

| Governance-Rating(0-10): | 5,885 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 25,580 % |

| Peergroup: |

Mixed Asset CHF Flexible

(43 Fonds) |

| Coverage rate ESG rating: | 61,947 % |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 184,684 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/03/2024

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Rolling performance in %

Risk metrics (22/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 7,63 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -4,98 % |

| Maximum Drawdown (1 year): | -4,84 % |

| Sharpe Ratio (2 years): | -0,31 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 28/03/2024

Top Ten Holdings in % of Fund Volume

| Equity Portfolio | Portfolio ex Equities | ||

|---|---|---|---|

| NOVO NORDISK A/S-B | 1.94% | Goldbarren | 30.26% |

| VISA INC-CLASS A SHARES | 1.72% | US TREASURY (3.50%) | 2.20% |

| HOLCIM LTD | 1.65% | BUONI POLIENNALI DEL TES (4.40%) | 1.54% |

| JPMORGAN CHASE & CO | 1.51% | FORTUM OYJ (2.1250%) | 1.46% |

| NVIDIA CORP | 1.45% | META PLATFORMS INC (3.50%) | 1.36% |

| AMAZON.COM INC | 1.45% | MARS INC (3.20%) | 1.35% |

| DEUTSCHE BOERSE AG | 1.38% | ANGLO AMERICAN CAPITAL (4.75%) | 1.05% |

| LINDE PLC | 1.31% | NESTLE HOLDINGS INC (4.00%) | 1.03% |

| MICROSOFT CORP | 1.29% | MCDONALD'S CORP (4.125%) | 1.03% |

| NOVARTIS AG-REG | 1.27% | US TREASURY(2.125%) | 1.01% |

Current status: 28/03/2024

When buying a fund, one acquires shares in the said fund, which invests in securities such as shares and/or in bonds, but not the securities themselves.

Top Country Allocation in % of Fund Volume (28/03/2024) |

|

|---|---|

| United States | 64,71 % |

| Germany | 7,81 % |

| France | 3,08 % |

| United Kingdom | 3,07 % |

| Switzerland | 2,92 % |

Asset allocation in % of the fund volume (28/03/2024) |

|

|---|---|

| Stocks | 38,71 % |

| Commodities | 30,26 % |

| Bonds | 30,05 % |

| Cash | 0,98 % |

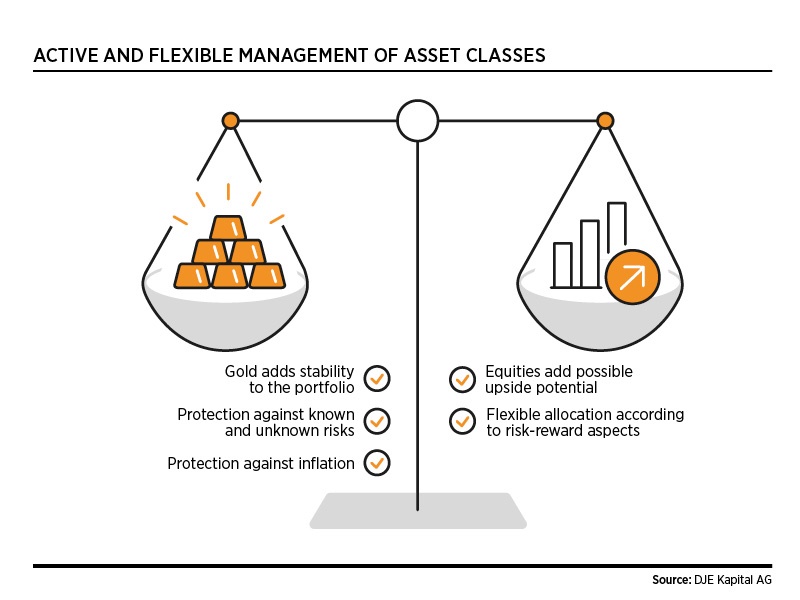

Investment strategy

The main focus of the DJE Gold & Stabilitätsfonds is gold investments. For generations, gold has been considered a reliable hedge against losses arising from economic crises and in times of rapid inflation. The portfolio also includes dividend-yielding equities, with defensive business models for low-risk diversification. The fund management selects primarily companies with a good asset base, and which have a proven-track record of stable performance even in volatile market phases. In fixed income, the fund only invests in bonds with investment grade ratings. The investment strategy of the DJE Gold & Stabilitätsfonds fund is flexible to adapt to constantly changing market conditions. Foreign currency risks may be hedged.

Chances

- Attractive initial investment level for global dividend and value stocks

- Under-investment by private and institutional investors and emerging market central banks with strong foreign currency reserves in the asset class of gold

- Investments in gold should have additional potential given the precious metal’s role as a monetary stabiliser in politically, socially and economically uncertain times

Risks

- Equity prices may exhibit relatively strong fluctuations depending on market conditions

- Investment in physical precious metals is subject to fluctuations

- Price risks for bonds, particularly when interest rates on the capital markets rise

- Currency risks resulting from the portfolio’s foreign (non-EUR) investments

Target group

Der Fonds eignet sich für Anleger

- with a medium to long-term investment horizon

- who wish to focus their equity investments on physical precious metals as well as defensive value investments

- who wish to minimise risk compared to a direct investment in gold

Der Fonds eignet sich nicht für Anleger

- who are not prepared to accept increased volatility and temporary losses

- who seek safe returns

- with a short-term investment horizon

Monthly Commentary

In March, the DJE Gold & Stabilitätsfonds rose by 6.63% in the fund currency, Swiss francs. In euro terms, the fund rose by 4.45% due to the depreciation of the Swiss franc against the euro. The troy ounce rose in price in March by 9.08% to USD 2,229.87 and by 9.02% to EUR 2,061.47. Including this development, gold rose by 8.1% in USD or 10.3% in EUR in the first quarter of 2024 and reached a new record high. Continued demand from central banks had a positive effect, especially from China, where the People's Bank of China (PBOC) further expanded its gold purchases. Demand for jewelry has also increased again in China since the beginning of the year, which is probably due to the fact that investment alternatives such as the Chinese stock and real estate markets still do not appear particularly attractive for investments. Gold was also supported by statements from members of the US Federal Reserve that three key interest rate cuts were still likely for the current year. Although the timing and extent of interest rate cuts remains uncertain, historically, low interest rates have proven to be positive for gold prices. The gold quota rose slightly from 29.90% to 30.26%. The global stock index MSCI World (including dividends) rose by 3.22% in March. All subsectors of the index performed positively in March. The strongest gains came from the energy and building materials & materials sectors (both overweight in the fund) and utilities (underweight in the fund). The sector allocation thus had a positive effect on the fund price development compared to the world stock index. The fund management increased the equity quota from 37.92% to 38.71%. On the bond side, the fund was able to benefit primarily from the reduced risk premiums on high-quality corporate bonds, while high-quality government bonds predominantly developed sideways. The fund's bond ratio remained almost unchanged at 30.05% (previous month: 30.71%). Liquidity fell from 1.47% to 0.98%.