Responsible Investing

Sustainability risks are investor risks.

We are therefore convinced that the consideration of sustainability criteria must be an elementary component of our trading, as failure to consider ecological ("E" for environmental) and social factors ("S" for social) and the lack of good corporate management ("G" for governance) can entail considerable risks. DJE has therefore long followed its own exclusion criteria, has been a signatory to the the United Nations-supported "Principles for Responsible Investment" since 2018, works with MSCI ESG Research, takes into account selected sustainable development goals, avoids or reduces adverse sustainability impacts, engages in over 500 discussions with corporate decision-makers per year and utilises the opportunities provided by the voting rights it holds.

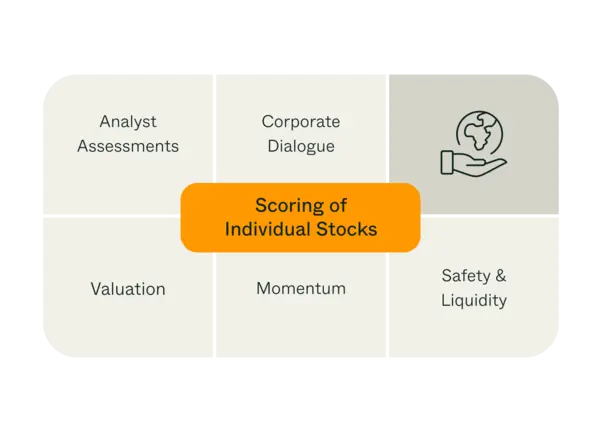

Sustainability in the investment process

In addition to our own analyses, we use detailed evaluations and quantitative scores from MSCI ESG Research, a leading provider of environmental, social and governance analyses and ratings. We evaluate a total of 37 sector-specific adjusted criteria from the areas of environment, social & governance (ESG) and derive a partial score for our individual stock selection.

Exclusion criteria

As a first step, we exclude various business areas when selecting individual securities for client portfolios and avoid companies that violate certain principles. These include companies that

violate the UN Global Compact*.

produce biological and chemical weapons, landmines, nuclear weapons, cluster bombs or uranium munitions.

generate >5% of their turnover from armaments.

Generate >30% turnover from thermal coal.

Generate >5% turnover from tobacco.

violate environmental criteria or cause controversy according to MSCI ESG Research.

In addition, we exclude government bonds whose issuers have a poor rating in the Freedom House Index or according to the World Bank indicators. These include the degree of democracy and freedom, the right of citizens to have a say, political stability and the accountability and performance of governments.

*UN Global Compact: A worldwide agreement between the United Nations and companies on compliance with human rights, labor standards, environmental principles and the fight against corruption.

Solid data basis

We use our own analyses and the results of MSCI ESG Research, a leading provider of environmental, social and governance analyses and ratings, to ensure that our investment decisions are based on the broadest possible data. The companies are analyzed according toCO2 emissions relative to sales, land and raw material consumption, water quality, biodiversity, ESG potential, strengths and weaknesses, controversies and corruption, among other things. MSCI ESG Ratings are available for more than 600,000 securities worldwide.

Negative sustainability impacts

An essential part of the sustainable earnings analysis consists of measuring a group of currently 18 indicators: the so-called PAI ("Principal Adverse Impact" indicators), which are also referred to as "adverse sustainability impacts". While 16 of the PAIs relate to companies, two further PAIs relate to government bonds. These can be divided into the following thematic groups:

Greenhouse gas emissions

Biodiversity

water

Waste

Social issues and employment

Positive contribution to sustainability goals

We also focus on four selected Sustainable Development Goals (SDGs) of the United Nations. Here we examine the extent to which a company contributes positively to one of the following goals and at the same time does not harm any of the other goals:

Gender equality (SDG 5)

Decent work and economic growth (SDG 8)

Sustainable consumption and production (SDG 12)

Climate action (SDG 13)

Commitment and voting rights

On average, we hold over 500 discussions with corporate decision-makers every year. This "engagement" is also about sustainability opportunities and risks - the latter are addressed critically. In addition, as a direct investor, i.e. as the fund company DJE Investment S.A., we exercise our voting rights with regard to ESG. We work together with Glass Lewis for this purpose. This partner advises us on how to exercise our voting rights as responsibly as possible.

Selection of products & individual securities of DJE Kapital AG

We directly implement our high standards with regard to sustainability criteria in direct investments. In order to ensure broad diversification in our portfolios, we can also use funds[1] from DJE and third-party providers or ETCs[2] in our asset management.

We cannot influence the selection of individual securities in the funds of third-party providers. Nevertheless, we also strive to comply with minimum standards when selecting funds. You can find out more about our sustainability policy here:

[1] "Fund" refers to actively and passively managed exchange-traded funds (ETF)

[2] ETC = a single exchange-traded commodity

ESG Committee

The ESG Committee consists of five members from the areas of research and portfolio management, fund management and trading, and sales. The Committee reviews compliance with sustainability criteria and exclusion lists and approves investments. It is also responsible for the design and ongoing adjustment of the company-wide ESG investment strategy.

Sustainability-related disclosure & sustainability of DJE Investment S.A.

Explanation of the main adverse impacts of investment decisions on sustainability factors (PAI Statement)

Sustainability for DJE Investment S.A. funds (via fund overview)

Sustainability policy of DJE Investment SA