Exports to Asia and Europe remain high, while growing trade barriers are making the environment more difficult

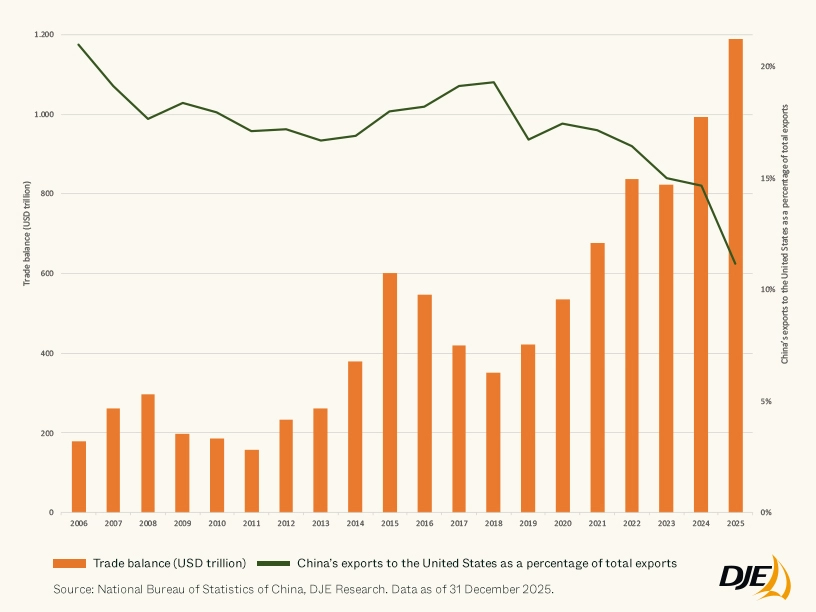

China's economy is caught between two forces. On the one hand, the ongoing real estate crisis continues to weigh on private consumption and large parts of the domestic economy, while on the other hand, foreign trade remains a key anchor of stability. As our chart of the month clearly shows, global demand for Chinese products remains robust despite geopolitical tensions and weaker US demand. The markets in Asia and Europe in particular contributed significantly to China achieving a record trade surplus of US$1.2 trillion in 2025.

At the same time, it is clear that China's model is heavily dependent on foreign countries. Without strong domestic consumption, which is recovering only slowly due to high household debt and the uncertain financial situation of many citizens, the country is dependent on exporting its production surpluses to the global market. The focus on exports is therefore not only a conscious strategic decision, but also a necessary economic support. Most recently, net exports contributed 20% to China's total economic output.

However, these high export surpluses are increasingly coming under international pressure. Across regions, there is growing concern about market distortions caused by low-priced Chinese goods, overcapacity in key industries, and dependencies in sensitive supply chains. Political countermeasures such as tariffs, industry support programs, or “de-risking” strategies could complicate the previously stable export flows in the future.

Nevertheless, our chart shows that global trade with China continues to flourish and is more important than ever for China. As long as domestic demand remains sluggish, the global market is indispensable for the country's economic stability.

Legal information

Marketing ad - All information published here is for your information only and does not constitute investment advice or any other recommendation. The statements contained in this video reflect the current assessment of DJE Kapital AG. These may change at any time without prior notice. All statements made have been made with care in accordance with the state of knowledge at the time of preparation. However, no guarantee and no liability can be assumed for the accuracy and completeness. The video and its content are protected by copyright. Long-term experience and awards do not guarantee investment success. Securities are subject to market-related price fluctuations that may not be offset by the active management of the asset manager. Please note our risk warnings.