In the run-up to Christmas, children’s rooms once again fill with new toys. What is now widely available at affordable prices was, for a long time, significantly more expensive and far from an incidental purchase for many households. Long-term price data illustrate just how fundamentally the toy market has changed over recent decades.

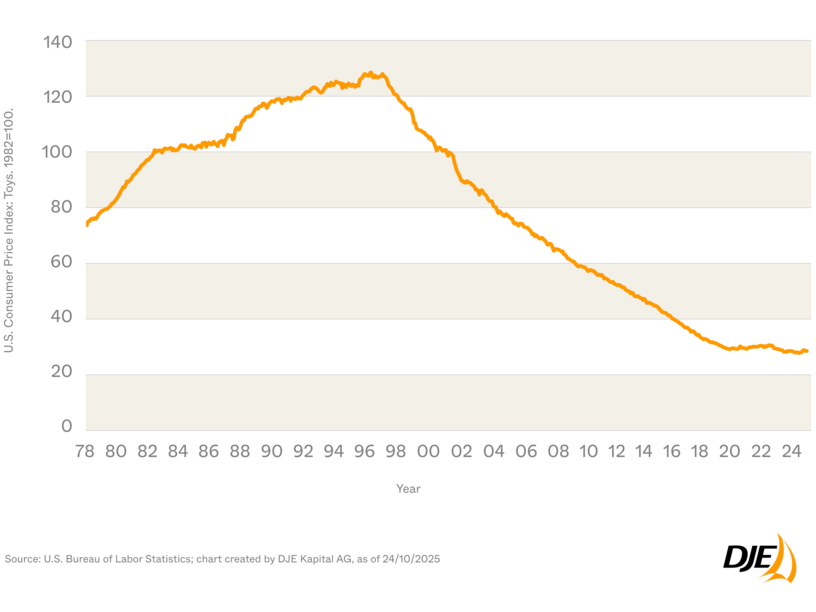

Toy prices in the United States have declined sharply since the mid-1990s. The corresponding consumer price index fell from around 125 in 1995 to approximately 27 in 2020, representing a price decline of roughly 80%. Over more than two decades, this equates to an average annual deflation rate of about 5–7%. Within the consumer basket, this development represents an absolute outlier.

Toys thus serve as a clear example of a broader group of globally tradable consumer goods. Prices for clothing, consumer electronics, and household appliances also stagnated or declined in real terms over extended periods in both the United States and Europe. Key drivers included productivity gains, globalization, and technological progress, which intensified international competition and enabled substantial economies of scale. Taken together, these forces exerted sustained downward pressure on prices for decades.

Against this backdrop, the broader inflation picture warrants closer attention. Between 1995 and 2020, average consumer price inflation in the United States stood at around 2% per year. However, this headline figure masks pronounced differences across individual categories of goods and services.

While prices for globalized consumer goods fell significantly in some cases, pricing pressure increasingly concentrated in areas that are not, or only to a limited extent, internationally tradable. This applies in particular to goods and services with a strong local component. U.S. house prices rose by approximately 150–200% in nominal terms between 1995 and 2020, with similar trends observed across many European countries—especially in major metropolitan areas. Rents and housing-related services typically increased by around 3–5% per year.

These opposing trends highlight the growing divergence in price dynamics. While globalized consumer goods markets exerted deflationary forces for decades and delivered real purchasing power gains, the real cost burden on households increasingly shifted toward housing and local services. The sharp decline in toy prices therefore does not signal broad-based price stability, but rather illustrates structural deflation in highly competitive goods markets—standing in stark contrast to persistent scarcity and rising prices in real estate and service markets across the United States and Europe.

Legal information

Marketing ad - All information published here is for your information only and does not constitute investment advice or any other recommendation. The statements contained in this video reflect the current assessment of DJE Kapital AG. These may change at any time without prior notice. All statements made have been made with care in accordance with the state of knowledge at the time of preparation. However, no guarantee and no liability can be assumed for the accuracy and completeness. The video and its content are protected by copyright. Long-term experience and awards do not guarantee investment success. Securities are subject to market-related price fluctuations that may not be offset by the active management of the asset manager. Please note our risk warnings.