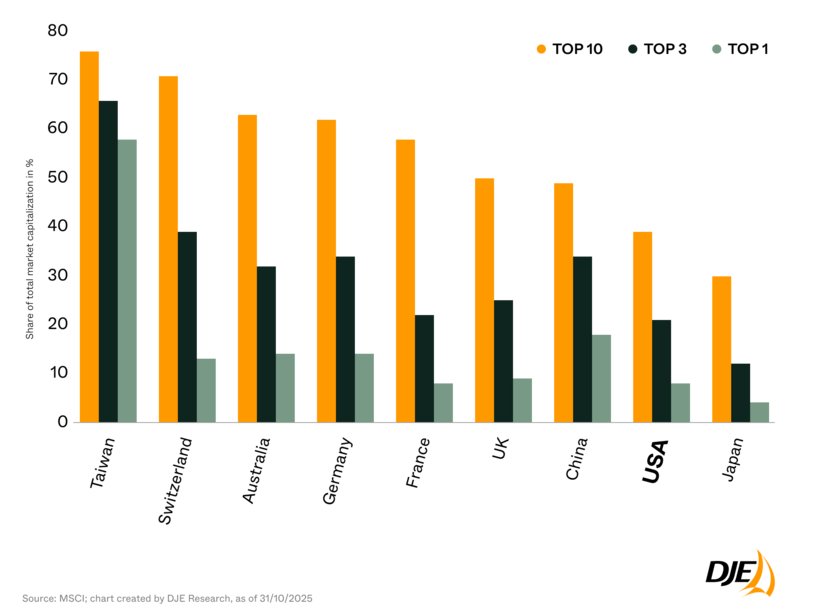

The U.S. equity market is often viewed through the lens of its dominant technology leaders, shaping the narrative of a highly concentrated environment. Yet a closer, data-driven assessment points to a different conclusion: in a global comparison, the United States remains one of the least concentrated major markets.

Evaluating the share of the largest constituents within each national market reveals a striking divergence. The largest U.S. company accounts for roughly 8% of total market capitalization — a notable figure, but comparatively modest. In several developed markets, including South Korea, Switzerland, and the Netherlands, a single company can exceed 20% of the market, with the top three or top ten names often exerting far greater influence.

This structural breadth in the United States has important implications. While U.S. mega caps capture disproportionate attention, the market is underpinned by a wide and diverse base of large, liquid companies across multiple sectors. This depth supports resilience, mitigates concentration risk, and provides a more balanced foundation for long-term portfolio construction.

In essence, the U.S. market hosts some of the world’s most prominent corporations — but it remains far from unduly dependent on them. Other advanced economies exhibit significantly higher reliance on a handful of national champions, underscoring the relative diversification embedded in the U.S. equity landscape.

Legal information

Marketing ad - All information published here is for your information only and does not constitute investment advice or any other recommendation. The statements contained in this video reflect the current assessment of DJE Kapital AG. These may change at any time without prior notice. All statements made have been made with care in accordance with the state of knowledge at the time of preparation. However, no guarantee and no liability can be assumed for the accuracy and completeness. The video and its content are protected by copyright. Long-term experience and awards do not guarantee investment success. Securities are subject to market-related price fluctuations that may not be offset by the active management of the asset manager. Please note our risk warnings.