Key information

The DWS Concept DJE Responsible Invest is a balanced fund that invests worldwide in equities (min. 25%) and bonds of sustainable companies (green bonds). Companies that exert a positive influence on society through products, processes or special commitment are considered sustainable. In addition, the fund may only invest in companies whose CO2 emissions are below very strict limits. This CO2 filter manifests itself in a very low carbon footprint at fund level. Investments in green bonds are bonds whose proceeds flow into pre-defined green projects - these can include reforestation projects, the establishment of recycling cycles or the improvement of drinking water treatment. The fund is fully geared to globally valid sustainability requirements.

Responsible manager since inception

Key information

| ISIN: | LU2018822143 |

| WKN: | A2PLLX |

| Category: | Fund EUR Flexible Allocation - Global |

| Minimum Equity: | 25% |

| Partial Exemption of Income ¹: | 15% |

| VG/KVG: | DWS Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 3 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | distribution |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 08/08/2019 |

| Fund currency: | EUR |

| Fund Size (25/04/2024): | 35,01 Mio EUR |

| Ongoing Charges p.a. (31/12/2020): | 0,74 % |

| Reference Index: | - |

Fees

| All-in fee p.a.: | 0,70 % |

Ratings & Awards (25/04/2024)

| Morningstar*: |

|

|

Awards: FNG Award 2024 Awarded with 2 stars (of 3) by Forum Nachhaltige Geldanlagen (Forum Sustainable Investments) |

no esg data available

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Rolling performance in %

Risk metrics (25/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 10,85 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -7,10 % |

| Maximum Drawdown (1 year): | -4,08 % |

| Sharpe Ratio (2 years): | -0,38 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 29/02/2024

Top Country Allocation in % of Fund Volume (28/03/2024) |

|

|---|---|

| United States | 39,50 % |

| Germany | 28,40 % |

| France | 8,10 % |

| Netherlands | 5,90 % |

| South Africa | 4,20 % |

Asset allocation in % of the fund volume (28/03/2024) |

|

|---|---|

| Stocks | 74,80 % |

| Bonds | 24,00 % |

| Cash | 1,20 % |

Investment strategy

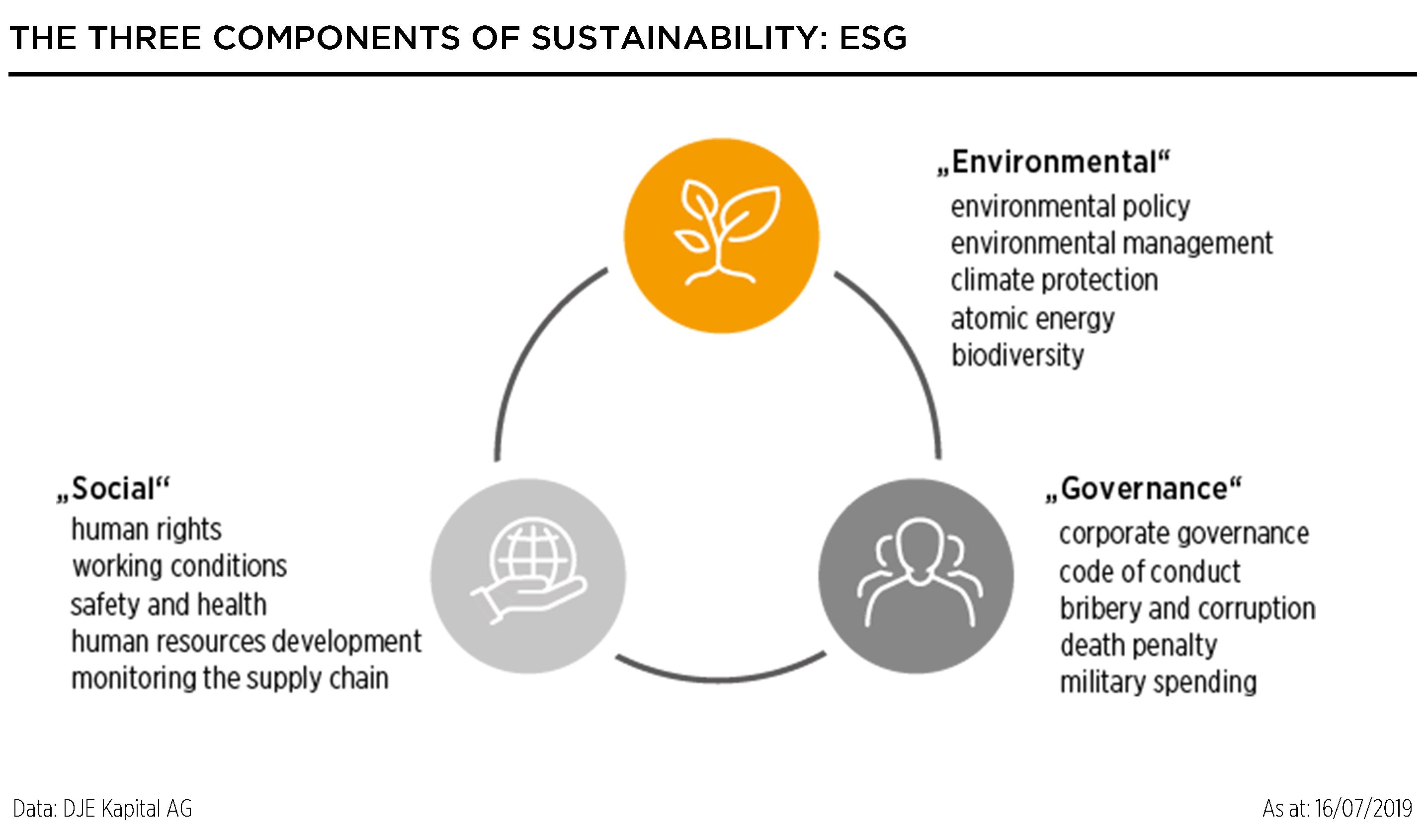

DJE works with MSCI ESG Research, a leading international provider of environmental, social and governance (ESG) analysis and ratings. The investment universe is examined on the basis of ESG filters. The fund management of the DWS Concept DJE Responsible Invest analyzes the closer selection qualitatively and invests in what it considers to be the most promising ESG leading stocks. Excluded are companies that violate United Nations regulations on human rights, labour rights and environmental protection or that generate more than 5% of their sales through weapons, gambling, nuclear energy, power plant coal or genetically modified seeds. On the equity side, the focus is on companies that have a positive impact on society and the environment. On the bond side, the fund invests primarily in "green bonds", i.e. bonds issued by companies that meet ESG criteria. Investment in government bonds is not the focus of attention, but is possible, provided there are no exclusion criteria such as high corruption, lack of freedom of the press or weak civil rights.

Chances

- Ongoing adjustment of the portfolio to the expected market conditions for strategic risk diversification

- Experienced fund manager with an approach based on fundamental, monetary and market analysis (FMM), enhanced by ESG filters

- Profit from the long-term investment trend Sustainability

- Participation in the growth opportunities of the equity and bond markets - no fixation on a region or a Country

Risks

- Currency risks due to foreign share

- No guarantee that securities of companies considered sustainable will perform above average

- Price risks of bonds with rising interest rates

- Country, credit and liquidity risks of issuers

- Equities carry risk of stronger price declines

Target group

Der Fonds eignet sich für Anleger

- with medium to long-term investment horizon

- who are looking for flexibility in portfolio design

- who wish to orient their investment in shares and bonds towards ESG criteria

Der Fonds eignet sich nicht für Anleger

- who seek safe returns

- who are not prepared to accept increased volatility

- with a short-term investment horizon

Monthly Commentary

In March, the stock markets were largely able to continue their bullish trend from the previous months. The rise in the stock markets in the first quarter was due to good or improving economic data, which turned out better than widely expected. These include continued solid figures from the US labor market, an improving purchasing managers' index for services in the euro area and fiscal stimulus in China, which should help achieve the growth target. This transformed the initial fears of recession into the hope that a soft landing for the major economic regions was still possible. As a result, interest rate cut expectations, which were still very high at the beginning of the year, have now shifted to the middle of the year. Especially since consumer prices in the USA rose again in February. Accordingly, the US Federal Reserve remained cautious and wants to wait for further data. In March, the European Central Bank signaled a first possible interest rate cut in June. The DWS Concept DJE Responsible Invest rose by 3.14% in this market environment. In March, all sectors of the global MSCI World stock index developed positively. The energy, credit institutions and basic materials sectors achieved particularly high growth. The lowest increases came from the consumer goods & services, travel & leisure and automobile sectors.

The source of all information and responsibility for its content and preparation lies with DJE Kapital AG, unless otherwise stated. The Management Company and Distributor of the Fund is DWS Investment GmbH. The statements contained in this document reflect the current assessment of DJE Kapital AG. The opinions expressed are subject to change without notice. All information in this overview has been provided with due care in accordance with the state of knowledge at the time of preparation. However, no guarantee or liability can be assumed for the correctness and completeness.

Sales prospectus and further documents

The supervisory and regulatory documents as well as the factsheet for this fund are available on the website of the investment company under the following link: DWS Concept DJE Responsible Invest FD