Key information

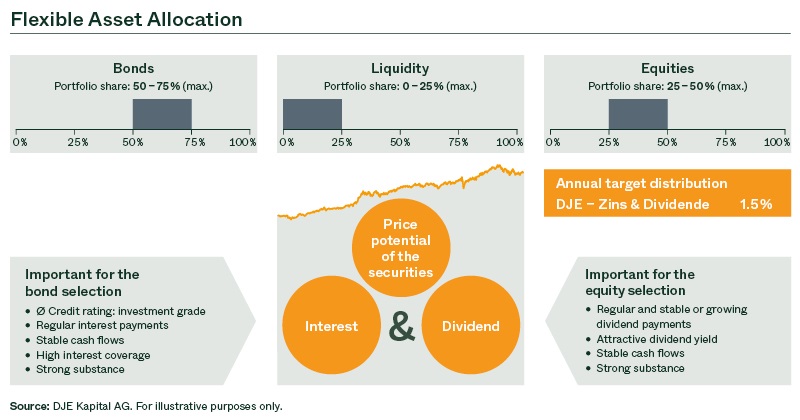

DJE - Zins & Dividende is a multi-asset fund managed independently from any benchmark. The fund aims for absolute returns with the help of conservative drawdown management. On the equity side, the fund invests primarily in equities with above-average dividend yields. The investment objective is to invest across asset classes and generate regular income from fixed income instruments, supplemented by capital gains and dividends on the equity side. The selection criteria for companies are recurring dividend payments as well as investor-friendly corporate policies such as stock buybacks. While the focus is on dividend paying stocks, the fund may also invest in companies that do not currently pay a dividend. The fund's flexible investment approach allows it to adapt quickly to changing market conditions. To reduce volatility, at least 50% of the fund is invested in bonds. Equity exposure fluctuates between 25% and 50%. Currency risks can be hedged opportunistically.

Responsible manager since inception

Responsible manager since 01/07/2019 as co-manager

Key information

| ISIN: | LU0553164731 |

| WKN: | A1C7Y8 |

| Category: | Fund EUR Moderate Allocation - Global |

| Minimum Equity: | 25% |

| Partial Exemption of Income ¹: | 15% |

| VG/KVG: | DJE Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 3 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | distribution |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 10/02/2011 |

| Fund currency: | EUR |

| Fund Size (25/04/2024): | 3.737,78 Mio EUR |

| TER p.a. (29/12/2023): | 1,69 % |

| Reference Index: | - |

Fees

| Initial Charge: | 4,000 % |

| Management Fee p.a.: | 1,500 % |

| Custodian Fee p.a.: | 0,060 % |

|

Performance Fee p.a.: 10% of the [Hurdle: exceeding 4% p.a.] unit value performance, provided the unit value at the end of the settlement period is higher than the highest unit value at the end of the previous settlement periods of the last 5 years [High Water Mark Principle]. The settlement period begins on 1 January and ends on 31 December of a calendar year. Payment is made at the end of the accounting period. For further details, see the sales prospectus. |

Ratings & Awards (25/04/2024)

| Morningstar*: |

|

|

Awards: Austrian Fund Award 2024 "Outstanding" in the category "Mixed Funds Global Balanced" Best Asset Manager 2023 Place 4 out of 381 funds in the category "Balanced" in the ranking of Wirtschaftswoche and MMD Mountain View Fund Awards 2023 Winner in the category "Mixed Funds Global Balanced" |

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | A |

| ESG-Qualityrating (0-10): | 6,758 |

| Environment Rating (0-10): | 6,475 |

| Social Rating (0-10): | 5,018 |

| Governance-Rating(0-10): | 5,614 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 17,350 % |

| Peergroup: |

Mixed Asset EUR Bal - Global

(784 Fonds) |

| Coverage rate ESG rating: | 89,318 % |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 155,013 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/03/2024

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Rolling performance in %

Risk metrics (25/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 6,39 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -4,02 % |

| Maximum Drawdown (1 year): | -3,06 % |

| Sharpe Ratio (2 years): | 0,04 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 28/03/2024

Top Ten Holdings in % of Fund Volume

| Equity Portfolio | Portfolio ex Equities | ||

|---|---|---|---|

| HANNOVER RUECKVERSICHERU-REG | 1.83% | MCDONALD'S CORP (2.625%) | 2.49% |

| LINDE PLC | 1.77% | MEX BONOS DESARR FIX RT | 2.12% |

| NVIDIA CORP | 1.74% | NORWEGIAN GOVERNMENT (1.75%) | 1.66% |

| TAIWAN SEMICONDUCTOR MANUFAC | 1.72% | ANGLO AMERICAN CAPITAL (2.625%) | 1.64% |

| VISA INC-CLASS A SHARES | 1.71% | NESTLE HOLDINGS INC (4.00%) | 1.43% |

| META PLATFORMS INC-CLASS A | 1.68% | FRAPORT AG (1.8750%) | 1.42% |

| JPMORGAN CHASE & CO | 1.65% | US TREASURY (2.625%) | 1.41% |

| ELI LILLY & CO | 1.58% | NIKE INC (2.40%) | 1.38% |

| AMAZON.COM INC | 1.47% | DEUTSCHE LUFTHANSA AG (3.00%) | 1.31% |

| NOVO NORDISK A/S-B | 1.44% | META PLATFORMS INC (3.85%) | 1.27% |

Current status: 28/03/2024

When buying a fund, one acquires shares in the said fund, which invests in securities such as shares and/or in bonds, but not the securities themselves.

Top Country Allocation in % of Fund Volume (28/03/2024) |

|

|---|---|

| United States | 46,49 % |

| Germany | 14,73 % |

| France | 4,14 % |

| United Kingdom | 3,20 % |

| Japan | 2,87 % |

Asset allocation in % of the fund volume (28/03/2024) |

|

|---|---|

| Bonds | 49,65 % |

| Stocks | 49,36 % |

| Cash | 0,99 % |

Investment strategy

The objective of DJE - Zins & Dividende is to generate a steady return – even in volatile markets. On the fixed income side, the fund invests primarily in debt instruments from sovereign issuers and corporates with investment-grade ratings. On the equity side, the fund relies on the established DJE dividend strategy. We believe that dividends can make a strong contribution to performance over time due to the compound interest effect. Time-series analysis shows that only around half of the equity returns are due to capital gains. The other half is attributable to dividends. The fund aims for an above-average dividend yield relative to the broader market. However, the fund may also include stocks that do not currently pay a dividend. The asset allocation is flexible and is adjusted depending on market environment. To reduce volatility, at least 50% of the fund are invested in bonds. Equity exposure fluctuates between 25% and 50%. Currency risks can be hedged opportunistically.

Chances

- Possible share price gains are complemented by interest income from international bonds and dividend distributions.

- Regular returns from interest and dividends can serve as a buffer in the event of stock market slumps.

- The balanced fund aims for a steady positive performance with low volatility in all market environments.

- The portfolio is continuously adjusted to the changing market environments.

Risks

- Share prices can fluctuate relatively strongly due to market, currency and individual value factors.

- The income from interest and dividends is not guaranteed.

- Bonds are subject to price risks if interest rates rise, as well as country risks and the creditworthiness and liquidity risks of their issuers.

- There is a currency risk for euro investors in securities not denominated in euros.

- The value of an investment may rise or fall and investors may not get back the amount invested.

Target group

Der Fonds eignet sich für Anleger

- who wish to take advantage of opportunities in both the equity and bond segments

- with a medium to long-term investment horizon

- who seek flexibility in portfolio design

Der Fonds eignet sich nicht für Anleger

- with a short-term investment horizon

- who are not prepared to accept increased volatility

- who seek safe returns

Monthly Commentary

In March, the equity markets largely continued their bullish trend from the previous months. The rise on the stock markets in the first quarter was driven by good or improving economic data, which turned out better than widely expected. These included continued solid figures from the US labour market, an improving purchasing managers' index for services in the eurozone and fiscal stimulus in China, which should help to achieve the growth target. This turned the initial fears of recession into hope that a soft landing in the major economic regions was still possible. As a result, expectations of interest rate cuts, which were still very high at the beginning of the year, have now shifted to the middle of the year. Especially as consumer prices in the USA rose again in February. The US Federal Reserve therefore remained cautious and intends to wait for further data. In turn, the European Central Bank signalled in March that it might cut interest rates for the first time in June. The DJE - Zins & Dividende rose by 2.26% in this market environment. All sectors of the MSCI World global equity index performed well in March. The energy, financial institutions and basic materials sectors achieved particularly high gains. The lowest gains came from the Consumer Goods & Services, Travel & Leisure and Automotive sectors. The fund benefited in particular from its exposure to the financial services, technology and healthcare sectors. The technology sector benefited from the ongoing boom in artificial intelligence, while selected pharmaceutical companies profited from their well-performing obesity products. On the other hand, the weakest results came from the telecommunications, property and utilities sectors. The latter suffered from higher energy purchase prices, while property companies continued to be burdened by the high interest rate level and the shift in interest rate cut expectations. The fund management adjusted the sector allocation slightly over the course of the month and increased the weighting of the technology, industry and financial services sectors, among others. In return, it reduced the healthcare and utilities sectors, among others. The equity allocation rose from 46.65% to 49.36% as a result of the adjustments. On the bond side, the fund benefited in particular from the lower risk premiums on high-quality corporate bonds and US high-yield bonds. However, high-yield European corporate bonds had a negative impact on performance, as the economic environment in the eurozone is not as stable as in the USA and key interest rates are not expected to be lowered until June - meaning that growth will continue to have to be financed more expensively. The fund management bought a US corporate bond from the technology sector and on the other hand reduced US and EUR government bonds and two corporate bonds from the construction and chemicals sector. As a result, the bond ratio fell from 51.79% to 49.65%. The fund's liquidity fell from 1.57% to 0.99%. At the end of the month, securities denominated in US dollars were partially currency-hedged. The currency hedging of securities denominated in Hong Kong dollars against the US dollar also remained in place.