Key information

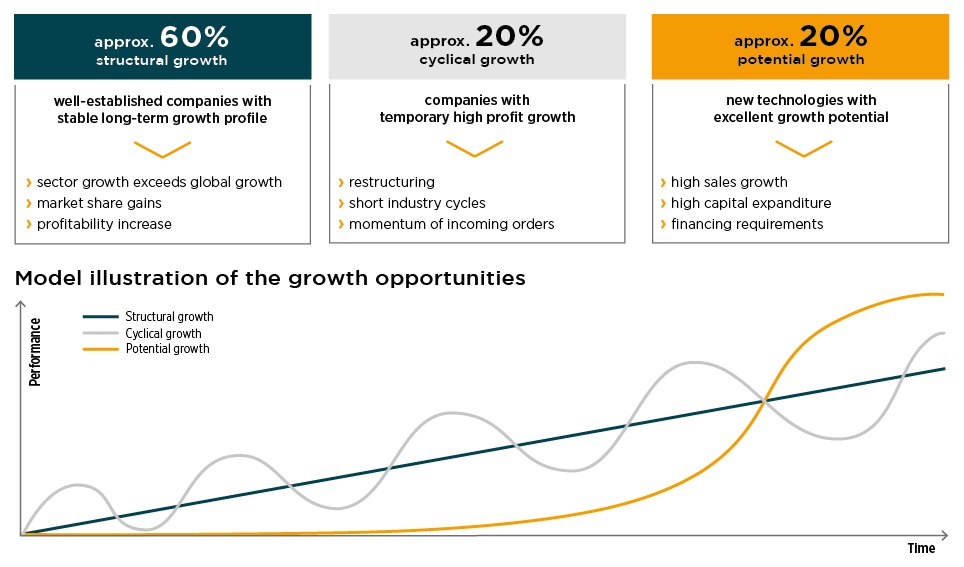

The investment focus of DJE - Mittelstand & Innovation is on high-growth, small- and mid-cap equities from Germany, Austria, and Switzerland. The diversification between structural, cyclical, and potential growth opportunities aims to deliver attractive risk-adjusted returns by investing in innovative niche players and “hidden champions”. The fund invests in a diversified portfolio of 50-80 equities identified through a disciplined fundamental analysis of the companies. DJE - Mittelstand & Innovation is an innovative investment solution for investors that are looking for a growth fund with an attractive risk-reward profile.

Responsible manager since 01/10/2022

Key information

| ISIN: | LU1227570055 |

| WKN: | A14SK0 |

| Category: | Fund Europe Small-Cap Equity |

| Minimum Equity: | 51% |

| Partial Exemption of Income ¹: | 30% |

| VG/KVG: | DJE Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 4 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | distribution |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 03/08/2015 |

| Fund currency: | EUR |

| Fund Size (24/04/2024): | 82,95 Mio EUR |

| TER p.a. (29/12/2023): | 1,97 % |

| Reference Index: | - |

Fees

| Initial Charge: | 5,000 % |

| Management Fee p.a.: | 1,650 % |

| Custodian Fee p.a.: | 0,060 % |

|

Performance Fee p.a.: 10% of the [Hurdle: exceeding 6% p.a.] unit value performance, provided the unit value at the end of the settlement period is higher than the highest unit value at the end of the previous settlement periods of the last 5 years [High Water Mark Principle]. The settlement period begins on 1 January and ends on 31 December of a calendar year. Payment is made at the end of the accounting period. For further details, see the sales prospectus. |

Ratings & Awards (24/04/2024)

| Morningstar*: |

|

|

Awards: €uro Eco Rating A Finanzen Verlag, Mountain View Q2 2023 |

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | A |

| ESG-Qualityrating (0-10): | 6,611 |

| Environment Rating (0-10): | 5,208 |

| Social Rating (0-10): | 5,197 |

| Governance-Rating(0-10): | 6,256 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 14,750 % |

| Peergroup: |

Equity Europe Sm&Mid Cap

(217 Fonds) |

| Coverage rate ESG rating: | 89,465 % |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 44,870 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/03/2024

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Rolling performance in %

Risk metrics (24/04/2024) |

|

|---|---|

| Standard Deviation (2 years): | 17,53 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -11,49 % |

| Maximum Drawdown (1 year): | -13,37 % |

| Sharpe Ratio (2 years): | -0,40 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 28/03/2024

Top Country Allocation in % of Fund Volume (28/03/2024) |

|

|---|---|

| Germany | 70,27 % |

| Switzerland | 14,15 % |

| Austria | 5,06 % |

| Netherlands | 4,72 % |

| Italy | 2,19 % |

Asset allocation in % of the fund volume (28/03/2024) |

|

|---|---|

| Stocks | 100,20 % |

| Cash | -0,20 % |

Investment strategy

The fund focuses on high-growth and innovative companies (“hidden champions”) in the DACH region (Germany, Austria, and Switzerland). In terms of market capitalisation, the fund mainly invests in small- and mid-cap companies. We have an active bottom-up approach that primarily focuses on fundamental analysis of the companies. The fund invests in equities with high, sustainable, and stable earnings growth. The aim is an attractive risk-reward profile with low maximum drawdown and low volatility.

Chances

- With over 1,500 companies, the German-speaking region is the core region of the "hidden champions" (unknown companies with a leading market position).

- The Mittelstand is the innovation, technology and economic engine of the D-A-CH region.

- Small and medium-sized companies usually have a higher growth potential than large corporations.

- The D-A-CH region is characterised by a stable domestic economy, high legal security and export strength, spread across many sectors.

Risks

- In addition to market price risks (equity, interest rate and currency risks), there are country and creditworthiness risks, e.g. a recession of the European economies.

- Share prices can fluctuate relatively strongly due to market, currency and individual value factors.

- Small and medium-sized companies are traded less on the stock exchanges than large corporations. Their share prices can therefore fluctuate more than those of large companies.

Target group

Der Fonds eignet sich für Anleger

- who would like to invest in medium-sized companies

- with a medium-to-long term investment horizon

- who prefer European titles

Der Fonds eignet sich nicht für Anleger

- who will not accept any increased value

- with a short-term investment horizon

- who seek safe yields

Monthly Commentary

As in previous months, the European stock markets largely made good progress in March. Initial fears of recession have turned into hope that a soft landing is still possible in the major economic regions. In the eurozone, the Purchasing Managers' Index for services reached 51.1 points in March, rising once again after February (50.2). This index is regarded as the most reliable economic barometer for the eurozone and suggests a modest economic recovery (values above 50 signal expansion). However, the index counterpart for the manufacturing industry fell to 45.7 points (previous month: 46.5), which indicates that the eurozone economy is still struggling with the effects of the key interest rate hikes and the rise in electricity and energy prices. In turn, the European Central Bank signalled in March that it might cut interest rates for the first time in June. Inflation in the eurozone fell to 2.6% in February compared to the previous year (January: 2.8%). DJE - Mittelstand & Innovation rose by 4.21% in this market environment. Particularly strong gains came from the media sector, with the top 10 position Eventim as the main performance driver, industry and automobiles. On the other hand, the technology, healthcare and property sectors, the latter due to the interest rate environment, weighed on the fund's performance. The fund management adjusted the sector allocation slightly over the course of the month. It increased the weighting of the healthcare sector in particular, as well as industrials and drugstores & food. In return, it reduced the Technology and Travel & Leisure sectors. At country level, the proportion of German stocks increased, while the proportion of Swiss and Austrian stocks fell slightly. As a result of the adjustments, the fund's investment ratio rose to 100.20% (previous month: 98.59%). Liquidity fell to -0.20%.