Key information

The fund invests primarily in equities that are directly or indirectly involved in agriculture or the food value chain. The asset allocation is managed independently of any benchmark constraints and the investment level can be reduced to 51% in difficult periods. Agricultural and food companies are expected to benefit from the structurally rising world population and drive long-term value appreciation. However, in the short term significant price fluctuations in agricultural commodities are possible. The fund refrains from investing in physical commodities or any derivatives, which benefit from rising food prices.

Responsible manager since inception

Key information

| ISIN: | LU0350836341 |

| WKN: | A0NGGE |

| Category: | Fund Sector Equity Agriculture |

| Minimum Equity: | 51% |

| Partial Exemption of Income ¹: | 30% |

| VG/KVG: | DJE Investment S.A. |

| Fund Management: | DJE Kapital AG |

| Risk Category: | 4 |

| This sub-fund/fund promotes ESG features in accordance with Article 8 of the Disclosure Regulation (EU Nr. 2019/2088). | |

| Type of Share: | distribution |

| Financial Year: | 01.01. - 31.12. |

| Launch Date: | 02/06/2008 |

| Fund currency: | EUR |

| Fund Size (25/07/2024): | 29,30 Mio EUR |

| TER p.a. (29/12/2023): | 1,06 % |

| Reference Index: | - |

Fees

| Management Fee p.a.: | 0,650 % |

| Custodian Fee p.a.: | 0,060 % |

Ratings & Awards (25/07/2024)

| Morningstar*: |

|

|

Awards: €uro Eco Rating A Finanzen Verlag, Mountain View Q3 2023 |

All ESG information presented here relates to the fund portfolio shown and is sourced from MSCI ESG Research, a leading provider of environmental, social and governance analysis and ratings.

| MSCI ESG RATING (AAA-CCC): | AA |

| ESG-Qualityrating (0-10): | 7,970 |

| Environment Rating (0-10): | 5,384 |

| Social Rating (0-10): | 5,329 |

| Governance-Rating(0-10): | 6,945 |

| ESG rating in comparison group (0% lowest, 100% highest value): | 89,740 % |

| Peergroup: |

Equity Theme - Agribusiness

(39 Fonds) |

| Coverage rate ESG rating: | 99,259 % |

| Weighted average CO₂ intensity (tons of CO₂ per 1 million US dollars in sales): | 141,313 |

Portfolio allocation according to ESG rating of individual securities

Report date: 28/06/2024

- The fiscal treatment depends on the personal circumstances of the respective client and can be subject of change in the future.

- is proprietary to Morningstar and/or ist content providers may not be copied or distributed and is not warranted ob e accurate, complete or timely. Neither Morningstar nor ist content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Perfomance Chart

Performance in Percent

Rolling performance in %

Risk metrics (25/07/2024) |

|

|---|---|

| Standard Deviation (2 years): | 8,58 % |

| Tracking Error (1 years): | - |

| Value at Risk (99% / 20 days): | -5,70 % |

| Maximum Drawdown (1 year): | -5,97 % |

| Sharpe Ratio (2 years): | -0,84 |

| Correlation (1 years): | - |

| Beta (1 years): | - |

| Treynor Ratio (1 years): | - |

Country allocation total portfolio (% NAV)

*Note: Cash position is included here because it is not assigned to any country or currency.

Data: Anevis Solutions GmbH, own illustration 28/06/2024

Top Country Allocation in % of Fund Volume (28/06/2024) |

|

|---|---|

| United States | 20,42 % |

| United Kingdom | 11,91 % |

| Switzerland | 11,84 % |

| Japan | 7,28 % |

| France | 5,90 % |

Asset allocation in % of the fund volume (28/06/2024) |

|

|---|---|

| Stocks | 96,22 % |

| Cash | 3,78 % |

Investment strategy

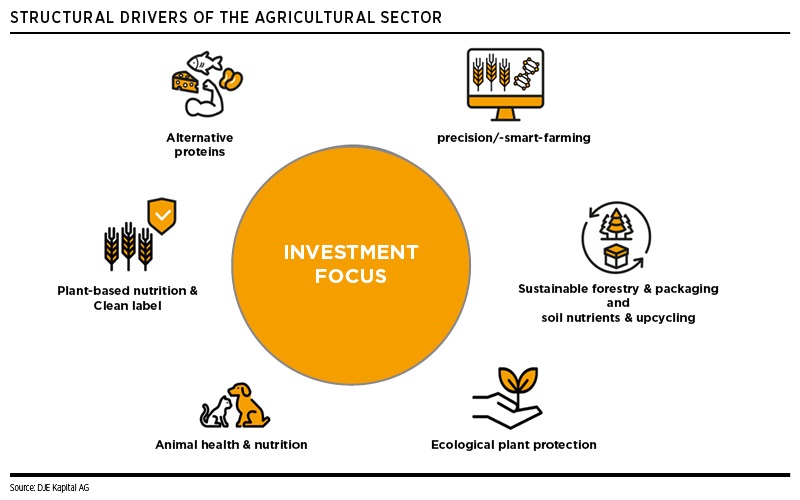

Aside from world population growth, the increasing demand for protein-rich foods resulting from rising living standards in developing countries is the main driver of agricultural prices. Moreover, increasing urbanisation is contributing to a shortfall of farmland, which is slowing the closing of the supply gap. According to the Food and Agriculture Organization of the United Nations (FAO), droughts and floods could reduce worldwide crop yields by another 20% to 40% in future. To alleviate this looming food shortfall, the demand for modern farm machinery and irrigation equipment, efficient seeds, pesticides and fertilizers, aquaculture and suitable animal feed is likely to increase significantly. The investment concept of DJE - Agrar & Ernährung is to select companies that benefit from these trends. In the case of falling commodity prices the fund, can benefit from investments within the food sector. To reduce risk the fund seeks to diversify the portfolio both thematically and regionally.

Chances

- Active portfolio management constantly monitors the industry

- Risk spreading via the professional selection of securities

- Attractive growth prospects in the agriculture and food sector

Risks

- Price risks for bonds, particularly when interest rates on the capital markets rise

- Issuer country and credit risks

- Increased risk of price fluctuations resulting from focus on specific sectors

- Equity prices may exhibit relatively strong fluctuations depending on market conditions

Target group

Der Fonds eignet sich für Anleger

- who wish to take advantage of global investment opportunities in this sector

- with a medium- to long-term investment horizon

- who seek a promising but more speculative mix of investments

Der Fonds eignet sich nicht für Anleger

- who are not prepared to accept increased volatility

- with a short-term investment horizon

- who seek safe returns

Monthly Commentary

After a large proportion of growth within the food industry was generated solely by passing on price increases in previous years due to inflation, the focus is now increasingly shifting back to product innovations. The latter are intended to boost volume sales and are generally supported by advertising measures at the same time. Depending on the product category, the financial leeway required for this is certainly available thanks to falling raw material and freight costs. However, suppliers of so-called "clean label" ingredients in particular are likely to benefit disproportionately from the increased interest in new product launches in the coming quarters. In addition to pure sugar and fat reduction and possible nutrient enrichment, further optimisation of the ingredients list is now also gaining in importance. By using fermented food cultures, for example, it is possible to reduce the need for the acidifiers that were previously used and significantly extend the shelf life of food. This in turn reduces food waste. Against this backdrop, the portfolio share of shares with exposure to so-called "clean label" solutions was increased again in June.