Commodities: no general supercycle, but selective opportunities - especially for copper

Gold investments are traditionally perceived as inflation protection. However, in 2021 gold only fulfilled this function to a limited extent. Although the inflation trend has accelerated strongly so far this year, most recently to +5.4 per cent in the USA and +2.2 per cent in Europe, the price of a troy ounce of gold is currently around $1,808/oz, a good 5 per cent below the level at the beginning of the year.

At first glance, this development is astonishing. With US real interest rates now at -3.8 per cent, one might have expected a better performance. Gold also hardly benefited from the Bitcoin crash. Gold and bitcoin have in common that they cannot be increased at will - and that the future supply is limited. Both forms of investment therefore have a certain "value preservation function". Although bitcoin more than halved in the meantime from its high in April of almost $65,000, gold was unable to benefit. This is probably due to the fact that gold ETF inflows have only risen marginally (40.7 tonnes) since April or in Q2. In the first half of 2021, there were even stronger outflows totalling a good 130 tonnes.

Gold ETFs: currently no support for the gold price

As is well known, investment demand, and here above all gold-backed index funds (ETFs), was the main driver of the gold price development in 2020. However, in view of an expected recovery in global economic activity, many investors are now withdrawing their money from gold ETFs, as they temporarily see better opportunities in other sectors. Looking at inflation, the gold price also seems to be pricing in a certain future normalisation - and thus following the forecast of the US Federal Reserve, which sees the current rise in inflation as only temporary. In this scenario and assuming moderately rising interest rates for ten-year US government bonds, future real interest rates would yield "less negative". Possible consequence: headwind for gold ETF purchases. On the demand side, gold is also experiencing further headwinds from low physical demand from the main gold buying countries India and China.

The strength of the US dollar has also been a burden on gold, but also on industrial metals and commodities in general. If the ECB pursues a more expansive monetary policy than the Fed in the future, the headwind from a stronger dollar could persist. Conclusion gold: Even if a certain gold deposit appears to make sense in the long term as a crisis hedge, the short-term risk-reward ratio should only be balanced. A rise towards highs seems unrealistic in the short term.

Industrial metals and other cyclical commodities facing a new super cycle?

In 2021, industrial metals such as copper and nickel (+26 per cent and +17 per cent in USD, respectively) or cyclical commodities such as iron ore performed significantly better than gold. Is this the beginning of the next supercycle - or is it a shorter normal upswing? The last commodity super-cycle started a good 20 years ago, triggered by China's industrialisation and accelerating urbanisation, and ended in 2011. Today, China accounts for about 50 per cent of global commodity demand. Without a high or rising demand for commodities from China, a new super-cycle appears unrealistic across the board.

China stimulated in 2020 to cope with the Corona pandemic. However, in the current year, the stimulus has been scaled back and measures have also been taken (liquidation of metal reserves, restrictions on speculative forward purchases) to contain price increases in many commodities. The recent trend in industrial metals is therefore mainly due to China's braking measures. In the medium to longer term, the Chinese government wants to restructure the country: away from a growth model based on (state) infrastructure investments towards an economy based on service and consumer services. This policy should be accompanied by a tendency towards lower demand for commodities - which thus also argues against a new broad super-cycle.

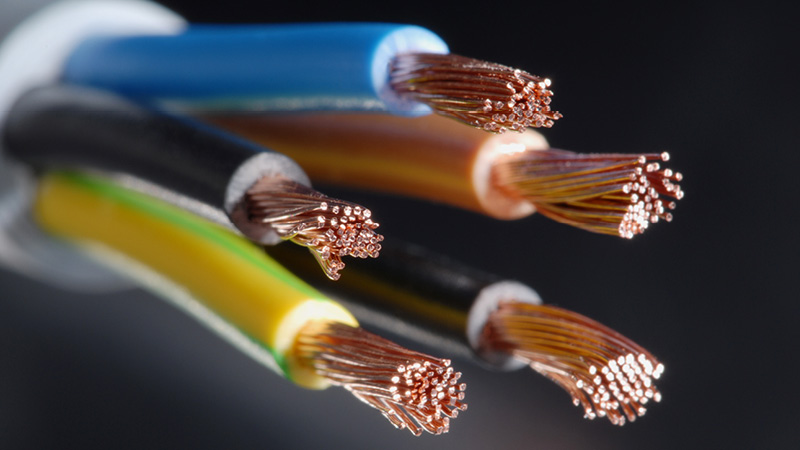

Base metals and climate change: Copper on the upswing

Nevertheless, a possible supercycle is conceivable for individual commodities. First and foremost is the best-known industrial metal, copper. Within the next ten years, global copper demand will be boosted above all by the energy transition and the electrification of road traffic, which are now becoming more and more the focus of global attention. The expansion of renewable energies such as wind or solar or the expansion of a charging network for electric cars will go hand in hand with high copper demand. In addition, there will be a large copper demand for electric car batteries in the future.

Taken together, these areas should lead to an additional copper demand of around three million tonnes per year by 2030. Already in the last nine years from 2011 to 2020, global copper demand increased by a volume of about five million tonnes to 25 million tonnes in 2020. The supply side (here above all mine production of about 20 million tonnes) could hardly keep up with this development.

Looking at the past ten years, the market was in a supply deficit in five years. This situation is likely to remain in the coming decade - also in view of significantly reduced investments by the mining companies in recent years. This speaks for high copper prices (currently $ 9,728/t) and thus good profits for the leading copper producers. Moreover, copper - unlike other raw materials such as oil, wood or aluminium - is practically non-substitutable. No other material conducts electricity as well as copper: without copper there will be neither the desired climate neutrality nor the desired success of electric vehicles (e-cars contain about five times the amount of copper as a combustion engine). In Germany, Aurubis is a leading global supplier of non-ferrous metals, especially copper. There could also be a super-cycle for lithium, which is essential for batteries and electricity storage.

ESG focus and resource nationalism

Increasing resource nationalism worldwide and an increasingly difficult permitting process for new mines should continue to put pressure on the supply side in the coming years. ESG criteria are becoming increasingly important for the companies. Those that are not very well positioned here could have a hard time expanding production (due to a lack of permits) or keeping it constant. From a sustainability perspective, for example, the diversified mining group Anglo American is very well positioned. Anglo American has also recently finally divested itself of all activities in the (power plant) coal sector to improve its sustainability ranking and offers the best growth profile in the copper sector among the large diversified mining groups.

Compared to the previous year, global gold mine production is expected to grow more strongly in 2021 . The second quarter of 2020 in particular was strongly characterised by temporary mine closures, so that the basis for comparison is particularly low here. However, forecasts of an increase to up to 3,700 tonnes in 2021 appear too optimistic. In the medium to longer term, the gold supply from mine production is likely to fall structurally, mainly due to the decreasing gold content in the rock and the low level of new gold discoveries in recent years. ESG criteria are also becoming increasingly important for gold mining companies. Taking these aspects into account, the world's leading gold company Newmont Mining is well positioned. Newmont is one of the best ESG-rated stocks in the commodities sector and also has a pipeline that should enable stable production while overall costs fall.

Come to stay: inflationary environment in the commodity sector

However, falling costs on trend are likely to be the exception rather than the rule in the sector. Due to rising prices for energy (electricity, petrol and especially diesel), steel, mining equipment and downstream probably also rising wages, rising costs are to be expected in the precious metals and commodities sector. Newmont with its falling overall cost profile (which is mainly due to the project pipeline) should be the exception. Most groups are expected to see a stronger increase in production costs compared to previous years. Generally, however, commodity prices again usually develop above average in times of higher inflation: according to recent calculations by the Bank of America, the correlation between the development of inflation and commodity prices from 1950 to 2020 was around 70 per cent.

Recycling instead of extraction

Rising production costs and difficulties in getting new projects approved or commissioned are likely to make the topic of precious metal and raw material recycling even more important in the coming years. In the medium to longer term, the recycling business should receive an additional growth impulse, especially through the recycling of e-car batteries that will then be necessary.

However, recycling and processing complex metal scrap or recycling e-car batteries is a technologically highly complex process that is also very capital-intensive - the barriers to entry into this business are therefore very high. With Umicore from Belgium and Aurubis from Germany, two European companies have a leading position in the recycling of complex metal and electronic scrap. In addition, recycling companies score well on ESG criteria: They are among the best-rated companies by rating agencies.

Note: This is a marketing advertisement. Please read the prospectus of the relevant fund and the KIID before making a final investment decision. These documents can be obtained free of charge in German at www.dje.de under the relevant fund. A summary of investor rights can be accessed in German free of charge in electronic form on the website at www.dje.de/summary-of-investor-rights. The funds described in this marketing announcement may have been notified for distribution in different EU Member States. Investors should note that the relevant management company may decide to discontinue the arrangements it has made for the distribution of the units of your funds in accordance with Directive 2009/65/EC and Article 32a of Directive 2011/61/EU. All information published here is for your information only, is subject to change and does not constitute investment advice or any other recommendation. The sole binding basis for the acquisition of the relevant fund is the above-mentioned documents in conjunction with the associated annual report and/or the semi-annual report. The statements contained in this document reflect the current assessment of DJE Kapital AG. The opinions expressed may change at any time without prior notice. All information in this overview has been provided with due care in accordance with the state of knowledge at the time of preparation. However, no guarantee or liability can be assumed for the correctness and completeness.